On Thursday, May 16, bitcoin quotes reached a ten-month high at $ 8,390 [Bitstamp], but then a sharp correction began, the goal of which could be $ 7,619, says CoinDesk Markets analyst Omkar Godboul.

To cancel the corrective movement, the bulls need to raise the price above $ 8,000. However, over the past 48 hours, Bitcoin has twice failed to consolidate above the psychological mark, and the RSI indicator speaks in favor of a significant overbought.

On the 4-hour chart, from the point of view of technical analysis, the situation is not very bright. If Bitcoin reaches $ 7619, the double top will confirm the bearish figure.

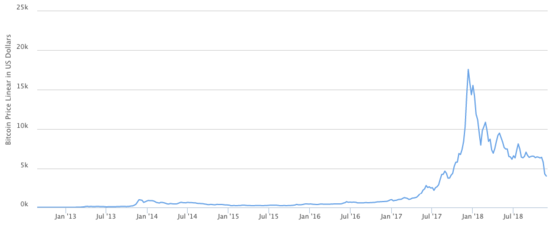

4 hour chart BTC / USD

This scenario supports the RSI indicator, which formed falling highs against the backdrop of a new record price – which indicates a bearish divergence. At the same time, the RSI has broken the downward triangle down.

Falling below the “neck” ($ 7,619) will open the way to $ 6,900.

The situation on the daily chart is better: the beginning of a bearish divergence is seen on the RSI, but the 10-day MA still speaks in favor of growth, so the fall to $ 7,000, if it is, it can be short-lived, according to Godboul.

daily schedule BTC / USD

The trend change to bearish, according to the schedule, will take place when it drops below the 30-day MA at $ 5,923. To change the situation, bulls need to return to $ 8,300, but this is quite difficult with an RSI above 70.

It is worth noting that the closing of short positions on Bitcoin on more than 10 thousand BTC was recorded that night on the Bitcoin exchange Bitfinex. Not so sharp decrease can be observed on the chart of long positions.

BTC / USD Shorts , TradingView data

BTC / USD Longs , TradingView data

At the time of writing, Bitcoin is trading at around $ 7,850.

Subscribe to the BlockchainJournal news in Telegram: BlockchainJournal Live – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news