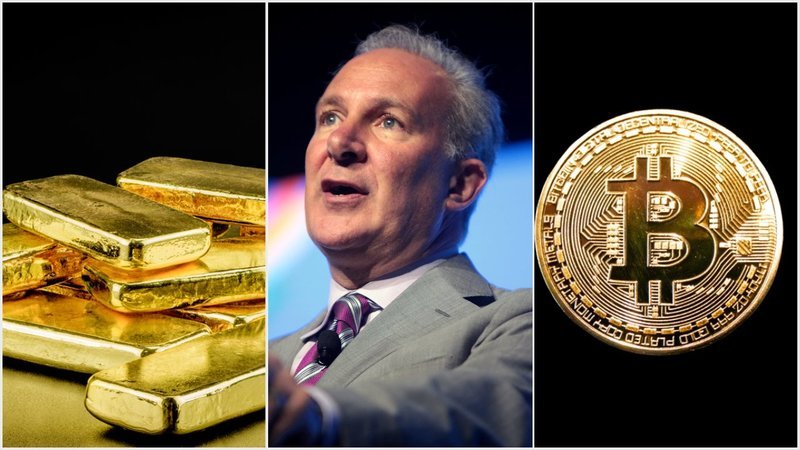

Peter Schiff, financial expert and implacable critic of bitcoin, said that last Friday the first cryptocurrency failed a test for a defensive asset. So, against the backdrop of a new round of the trade war between China and the United States, the Japanese yen, the Swiss franc, gold and silver showed growth, while Bitcoin and the stock market showed a collapse.

Bitcoin has again failed the safe haven test. On Friday, as escalating trade tensions sent global stock markets plunging, investors sought refuge in monetary safe havens. The Japanese yen, Swiss franc, and especially gold all moved higher. Yet Bitcoin plunged by more than stocks!

– Peter Schiff (@PeterSchiff) August 28, 2019

Since last Thursday Bitcoin has lost more value than any of the major stock market indexes, while gold and silver have gone up. You can keeping looking in the rear view mirror while ignoring what's happening right in front of you!

– Peter Schiff (@PeterSchiff) August 28, 2019

It is noteworthy that the co-founder of Fundstrat agency Tom Lee, an avid bitcoin optimist, agreed with the opinion of the opponent.

Very solid argument. Can't dispute that

– Thomas Lee (@fundstrat) August 28, 2019

“A very firm argument. It’s hard to argue. ”

The theory that Bitcoin is a defensive asset in times of political and economic instability has gained popularity in recent months amid a fierce trade war between China and the United States. Many analysts are convinced that in an attempt to hedge risks, investors use not only gold, but also the first cryptocurrency, but no one has yet provided evidence of the truth of this theory.

Nevertheless, it should be noted that bitcoin is really popular in countries where high inflation or hyperinflation is recorded ( Argentina , Venezuela), as well as where political uncertainty reigns ( Hong Kong ).

More details about the influence of macroeconomic factors on bitcoin can be found in the special topic .

You can agree or reject Schiff’s arguments in our survey . At the time of writing, Schiff is losing.

Subscribe to BlockchainJournal news on Telegram: BlockchainJournal Feed – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news