Large mining pools BTC.com and BTC.top carried out a “51% attack” to cancel the transaction of another miner who tried to gain access to funds that did not belong to him, reports CoinDesk .

Thus, during the last hard forks, which took place on May 15, an unknown attacker took advantage of the vulnerability in the Bitcoin Cash protocol and provoked the chain fork into two alternatives. This led to the fact that miners for some time mined empty blocks.

It turned out that at the moment when Bitcoin Cash separated from Bitcoin in 2017, a large number of coins were created, which were accidentally transferred to the addresses anyone can spend . Nevertheless, the developers implemented the rule CLEANSTACK, according to which all these coins were blocked. However, the last hardfork removed this rule from the protocol and allowed the unknown miner to appropriate the coins.

3 /

Of the this Because, tons of coins ( #BCH ) Would Essentially the BE «up closeup for grabs a.» HOWEVER, devs Implemented a protocol rule Called CLEANSTACK, P2SH-making coins unspendable.15, basically handing the coins to miners. https://t.co/ITT9djMSSo

– Guy Swann⚡ (@TheCryptoconomy) May 24, 2019

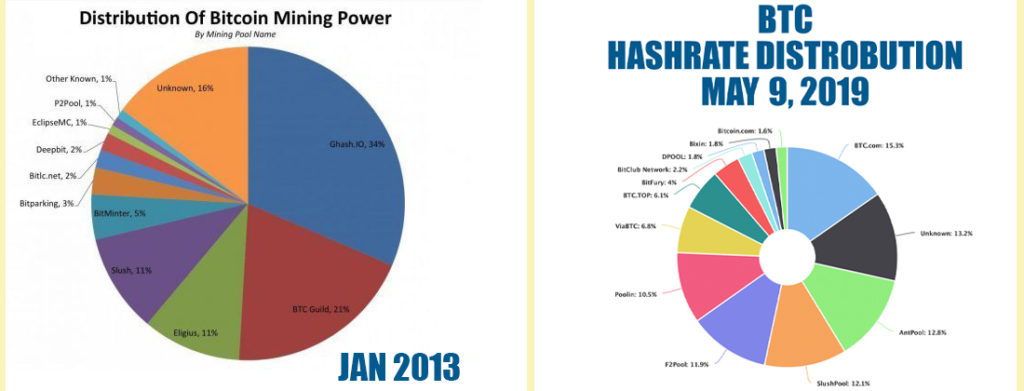

BTC.com and BTC.top, which control more than half of the network's hashrate, most likely were aware of the fact that such a problem could arise, or could even get ready to take possession of the coins. Anyway, they quickly reorganized the network.

7 /

According to discussions, https://t.co/5160YC8BRd and https://t.co/2gkV6KUcCt were #SegWit coins to rightful owners (exchanges and / or users).How they sourced the rightful owners "reddit consensus." ?

– Guy Swann⚡ (@TheCryptoconomy) May 24, 2019

eight/

When he tried to take the coins themselves, https://t.co/gZNf6P1G3l & https://t.co/h08wTM6XgZ TXs, spending the same P2SH coins, + many others. https://t.co/jNzqgOh4km– Guy Swann⚡ (@TheCryptoconomy) May 24, 2019

It can be assumed that there will soon be a lively discussion around this incident, since the miners actually subjected the network to severe censorship, although their intentions this time seem to be good.

Recall that in April last year, a vulnerability was discovered in the Bitcoin Cash network, which made it possible to divide the blockchain into two incompatible chains and completely block all transactions. This would lead to disastrous consequences for the fourth cryptocurrency capitalization.

Subscribe to the BlockchainJournal news in Telegram: BlockchainJournal Live – the entire news feed, BlockchainJournal – the most important news and polls.

BlockchainJournal.news

BlockchainJournal.news