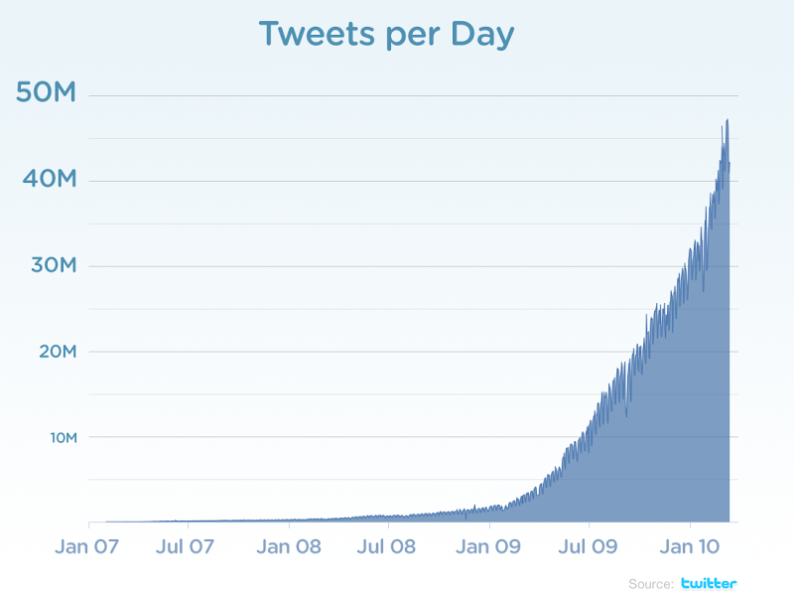

Cryptanalyst Murad Makhmudov notes that currently the average daily number of Twitter posts on Bitcoin is at the 2014 level.

1 / This screams bearish.

Tweets about 2014What is an absolute disaster in my opinion. pic.twitter.com/DTdsUepx1t

– Murad Mahmudov ? (@MustStopMurad) 3 February 2019 р.

The analyst also stressed that bitcoin is remembered even less than in 2016. This, in his opinion, is clearly a “bearish” signal for the medium term.

He believes that greed and speculation are still on the market. Decentralization few people care.

3 / There are few people who are sovereign sovereign.

Cryptocurrency's biggest use case is speculation. That is a fact.

For better or worse, Speculation and human greed are your biggest hope.– Murad Mahmudov ? (@MustStopMurad) 3 February 2019 р.

Makhmudov is also confident that the market will once again become attractive to "value investors" when the price drops even lower than the current level.

If you’re a little bit more interested

– Murad Mahmudov ? (@MustStopMurad) 3 February 2019 р.

He is convinced that the duration of the bear market is prolonged by global economic instability and the perception of Bitcoin as a risky asset.

9 / While still being perceived as a risk asset.

This bear market will last longer. Those who are building, learning, studying will be rewarded in 2023/24.

– Murad Mahmudov ? (@MustStopMurad) 3 February 2019 р.

“This bear market will last much longer. Those who are creating and learning right now will undoubtedly be generously rewarded in 2023-2024. ”

Earlier, Murad Makhmudov noted that Bitcoin has yet to become a liquid and reliable means of preserving value, a generally accepted means of exchange, a convenient monetary unit, and then world money.

This requires more decentralization, custodial decisions and legal certainty. Also important are the development of the network effect, price stabilization, better recognition and mass adoption.

Follow BlockchainJournal on Twitter !

BlockchainJournal.news

BlockchainJournal.news