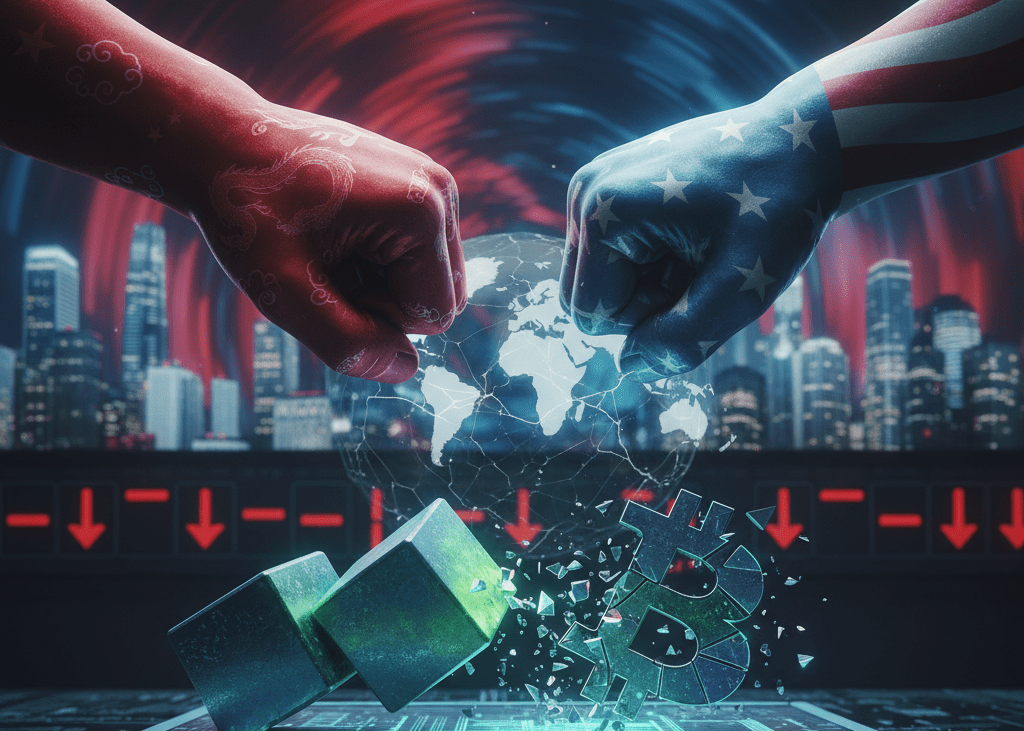

The cryptocurrency market experienced a massive sell-off exceeding $500 million in a matter of hours. This drop was a direct reaction to the announcement from China’s Ministry of Commerce, which reported a tightening of export controls on rare earth magnets, a retaliatory measure against tariffs imposed by the United States. Trade tension has negatively impacted global markets.

The figures from the crash reflect the severity of the market’s reaction. The total cryptocurrency market capitalization fell by 3.2%, while leading assets like Bitcoin and Ethereum recorded losses of 3.1% and 5.1% respectively. Furthermore, more than 1.66 million traders were liquidated, underscoring the high volatility. The Fear & Greed Index plummeted from a “Greed” level (64) to “Fear” (27), its lowest point in six months.

The context for this measure is the trade war between the two powers. China controls over 90% of the world’s rare earth processing capacity. Therefore, it uses this dominance as a powerful geopolitical lever. These raw materials are absolutely crucial for manufacturing high-tech components, including the GPU and ASIC chips that are essential for cryptocurrency mining. The restriction threatens to increase hardware costs and affect the sector’s profitability.

This situation adds a new layer of uncertainty to an already fragile global economy. China’s restrictions on rare earths are not only a response to tariff policies but also a show of force. For investors, this translates into greater risk aversion, as geopolitical instability encourages the sale of volatile assets like cryptocurrencies in search of safer, more traditional havens.

A Buying Opportunity Amid Widespread Panic?

The immediate impact has been a sharp correction in prices. However, subsequent statements from both sides suggest the situation could change quickly. While China defended its actions as “legitimate,” the United States showed a more conciliatory tone, indicating its intention to “help, not hurt.” This volatility creates both risks and potential opportunities for investors attentive to market movements and diplomatic signals.

The short-term future of the crypto market appears to be strongly tied to the evolution of these trade tensions. Traders will need to closely monitor not only technical indicators but also official communications from Beijing and Washington. The technological dependence on rare earths means that any move on this geopolitical chessboard will have direct repercussions on the sector, affecting everything from hardware production costs to general investor sentiment.