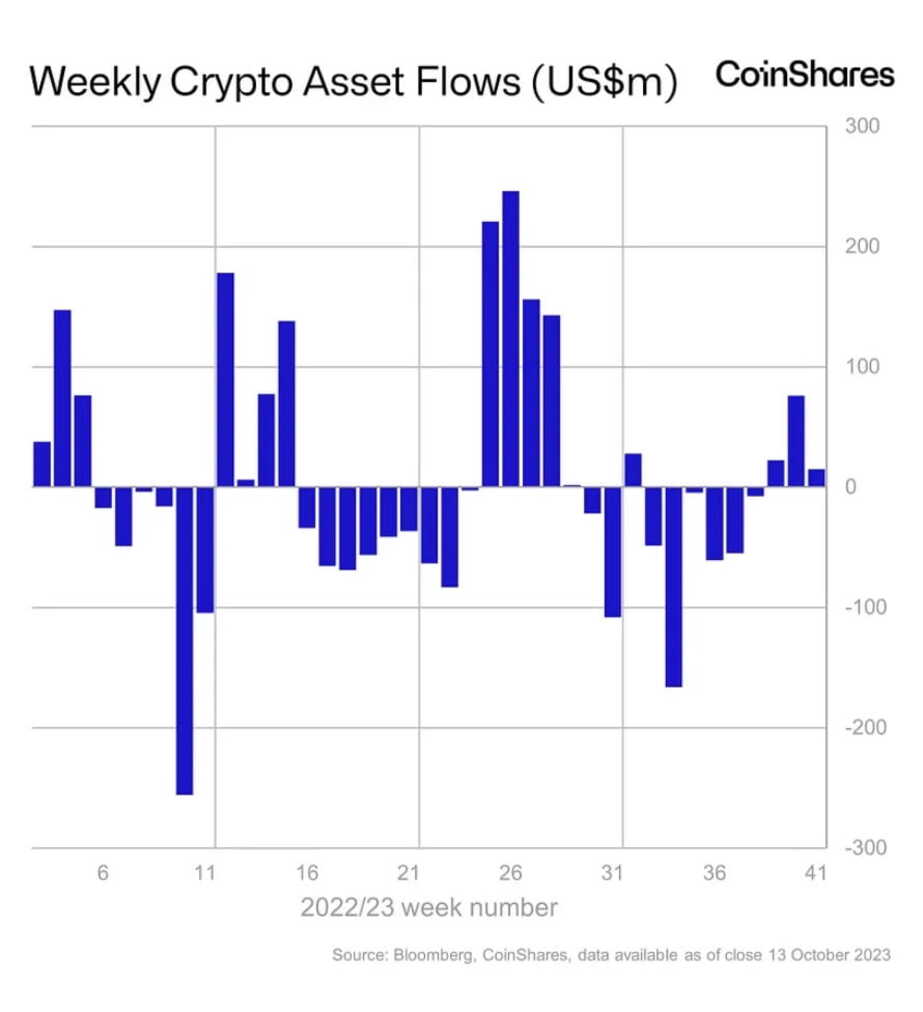

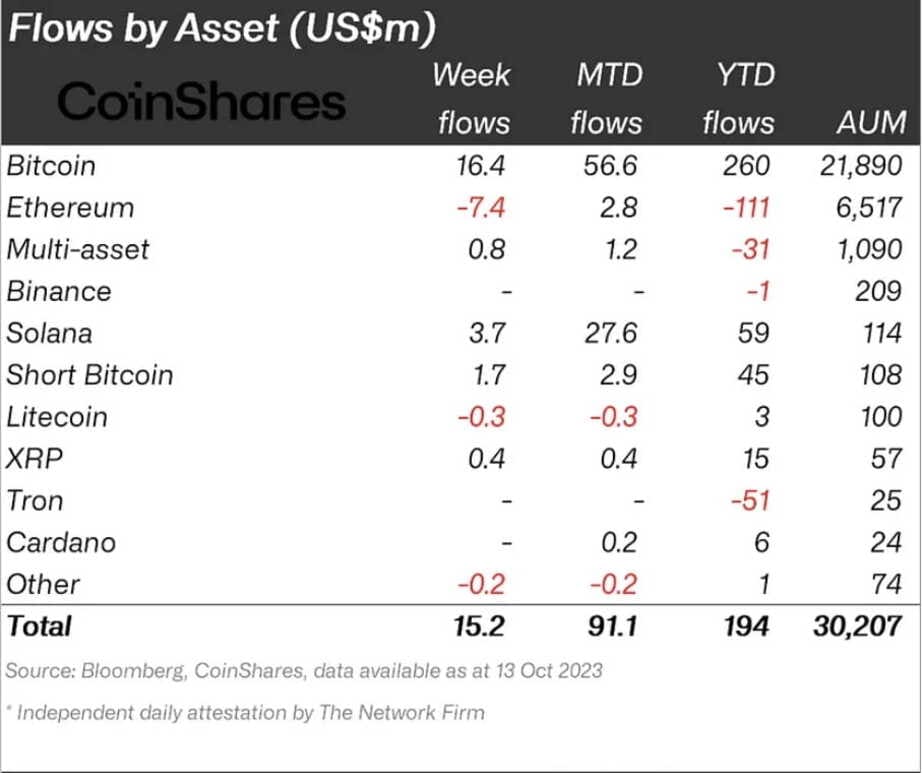

Investment in digital assets continues to rise. It recorded its third consecutive week of net inflows. Bitcoin took the top spot with an inflow of $16 million this week. The market-leading cryptocurrency has accumulated a total of approximately $260 million in inflows for the year, according to a report by CoinShares.

The SEC Won’t Appeal

This positive trend is being driven by the news that the SEC decided not to appeal in the case against Grayscale. This could pave the way for the creation of an ETF.

Other products that saw growth included Solana, which bolstered an inflow of $3.7 million, adding to the $24 million from the previous week. Short Bitcoin funds also posted revenues of approximately $1.7 million. Meanwhile, XRP, despite recording a modest amount of $0.42 million, achieved its 25th consecutive week of net inflows. The consistent inflows highlight the support of the investment community.

Unfortunately, the market wasn’t favorable for all cryptocurrencies. Despite the launch of Ether futures ETFs last week, Ether saw outflows of $7.4 million, effectively undoing the $10 million in inflows it had received the previous week. According to James Butterfill, Head of Research at CoinShares, this may be due to current concerns about the protocol’s design.

Other funds that recorded outflows included Chainlink, Litecoin, and Tezos, with amounts of $0.31 million, $0.28 million, and $0.25 million, respectively.

Despite the consecutive net inflows, the trading volume remains 27% lower compared to the 2023 average. The United States recorded minimal inflows of $2.1 million, while Germany led the list with $16.1 million in inflows. Canada registered inflows of $3.5 million. Sweden was the only European country to report outflows, totaling $7.5 million.

For now, the numbers don’t seem to reflect the good news surrounding the SEC’s decision regarding Grayscale. As the cryptocurrency market continues to evolve, the impact of regulatory decisions like these will likely play a pivotal role in shaping investor sentiment. As cryptocurrency investments become more integrated into the traditional financial landscape, the interplay of these elements will continue to shape the market’s trajectory.