Bitcoin News

Bitcoin: Bullish Trend Leads to Asset Outflows from Exchanges

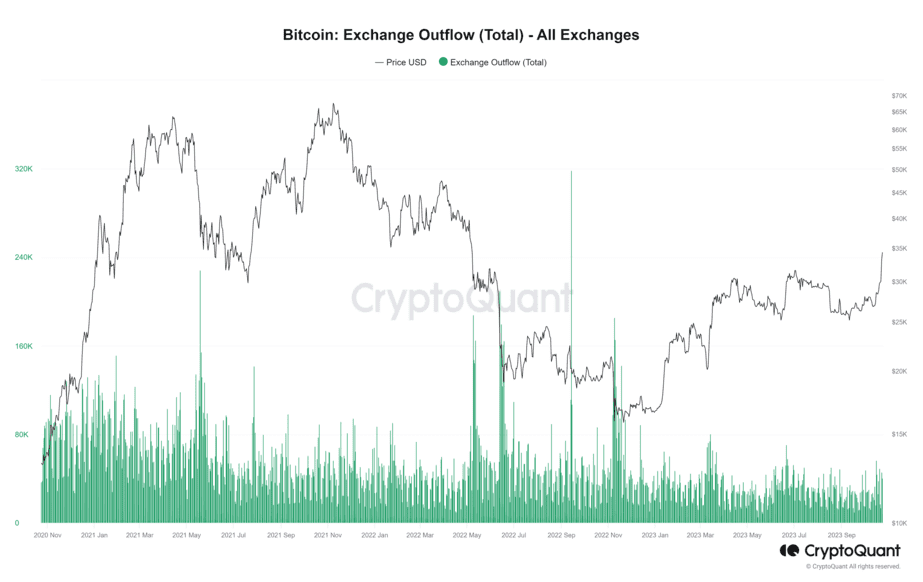

Bitcoin recently reached $35,000, touching that level for the first time in a year. The surge in BTC’s price set off a series of movements in the market, including a significant outflow of assets from exchanges.

The outflow of assets from these exchanges is seen as a positive sign, indicating that traders and investors are withdrawing their assets from these platforms with the intention of preserving them rather than selling. In other words, they are betting on Bitcoin’s prices continuing to rise.

Binance leads the way in this asset outflow, with over $500 million withdrawn from the platform in a 24-hour period. They were followed by crypto.com, with $49.4 million in outflows, and OKX, with $31 million. Other exchanges recorded more modest outflows, generally below $20 million. This data is presented by CryptoQuant.

Bitcoin Reflects Investor Optimism

The outflow of assets marks a contrast with the panic-driven withdrawals seen after the collapse of FTX in November 2022. Instead, these outflows appear to reflect the optimistic sentiment of traders who anticipate Bitcoin’s price to continue rising.

Furthermore, the increase in Bitcoin’s price led to the liquidation of approximately $400 million in short positions within a 24-hour period. Around 94,755 traders witnessed their derivative positions being liquidated, with the largest liquidation order taking place on Binance, amounting to $9.98 million.

Analysts are also keeping an eye on the “market value to realized value” (MVRV) ratio, which compares Bitcoin’s market value to its realized value. Currently, this ratio stands at 1.47. Historically, a similar value of 1.5 has coincided with a bullish period in the market.

#Bitcoin hit $35K. Wallets in profits hit 79.72%.

The Bull Market starts when the MV Ratio stays above 1.5.

We're now at 1.47. I'm positive about #bitcoin hitting $40K in the next few days, which will send the MV ratio to 1.6. pic.twitter.com/uCgdNLGRnq

— hitesh.eth (@hmalviya9) October 24, 2023

The overall market has experienced a 7.3% increase in its total value over the past 24 hours, reaching a valuation of $1.25 trillion, its highest level since April. This surge is attributed, in part, to the speculation surrounding the imminent launch of a Bitcoin exchange-traded fund (ETF).