Fundstrat analyst Tom Lee believes that next week we will have to wait for the resumption of aggressive growth of Bitcoin (BTC) due to the easing of monetary policy by the US Federal Reserve.

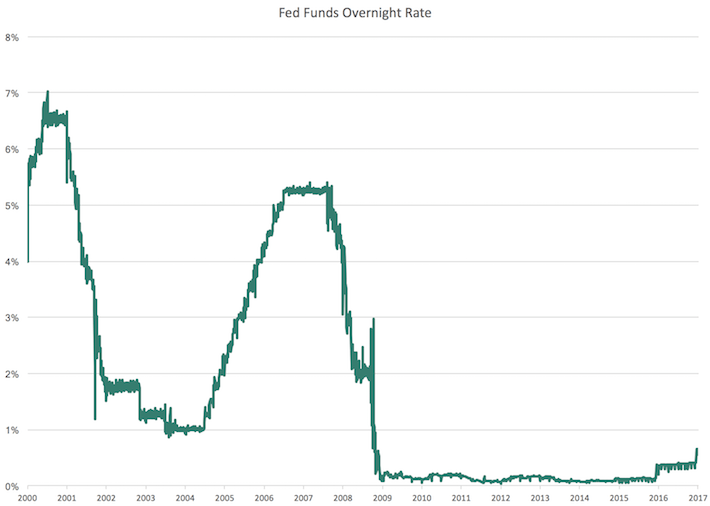

On Twitter, an expert wrote that over the past few days, BTC has dropped significantly in price, but the coin is still holding above $ 9,000. The Fed is expected to lower the discount rate, which will weaken the demand for US assets backed by the dollar.

Tom Lee stressed :

"Lower rates – a weaker dollar is a bitcoin increase."

Weekend is led in weakness in #bitcoin

– Fed is expected to cut interest rates next week.

– Lower rates = weaker USD = Upside for Bitcoin $ BTC

– So expect a bit of a weekend to break this pattern. #BTFD pic.twitter.com/algixbrrEB

– Thomas Lee (@fundstrat) July 27, 2019

He is confident that the loss of positions at the end of this week was a temporary phenomenon, and after a few days, a repeated rally will be inevitable.

Another BTC supporter, Anthony Pompiano, founder of Morgan Creek, shares a similar point of view. He is also looking forward to reducing the Fed discount rate. According to him, the conditions for such a step have already been created, as the US economy is shrinking.

The decline in GDP is one of the main factors that play in favor of easing monetary policy. In this case, switching investors from the dollar to alternative instruments will be their response to a decrease in the yield of US securities.

HERE WE GO.

US GDP last quarter: 3.1%

US GDP this quarter: 2.1%Economy slowing down only means one thing – cutting rates and printing money!

They were not aware of what they were giving.

Long Bitcoin, Short the Bankers!

– Pomp ? (@APompliano) July 26, 2019

Publication date 07/29/2019

Share this material on social networks and leave your opinion in the comments below.