First of all, everyone is now paying attention to Bitcoin (BTC), but other crypto assets have also shown high profits since the beginning of 2019. This called for the fact that the so-called “alternative season” was in full swing.

By definition Fundstrat "season of altcoins" is when a large percentage of altcoins grows by more than 200% in a short period of time.

For example, the Binance Coin coin recently showed its record high, and it happened in a foul bear market. Litecoin also grew, showing a 200% increase from the end of 2018. Cardano, Ethereum, Tezos, and the Basic Attention Token token are among other well-known cryptocurrencies that have also shown tremendous growth over the past 90 days.

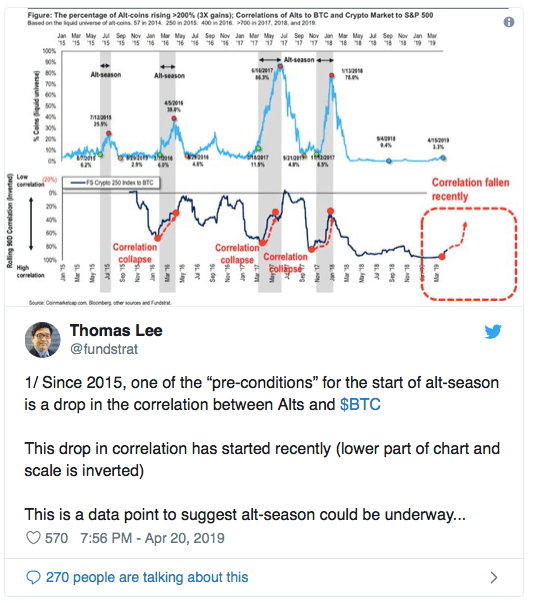

Tom Lee drew attention to the decline in the correlation between the class of cryptoactive assets in general and Bitcoin itself.

According to the chart he posted on Twitter, the fall of the sliding 90-day correlation between these two subsets preceded the three “altcoin seasons” starting in March 2016 and beginning in 2018.

However, the "Altcoin season" may already be over. On Wednesday, Bitcoin dominance was 54.4%, which is the highest since mid-December, when BTC reached $ 3,000.

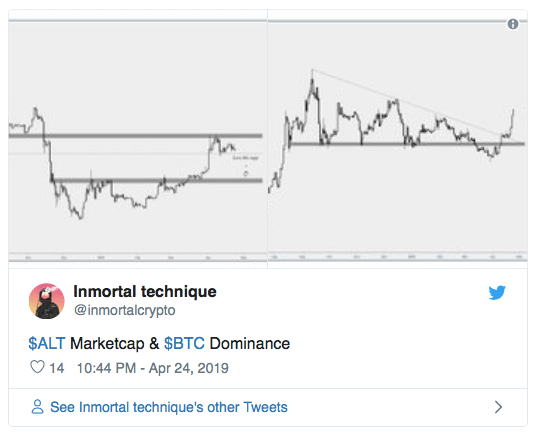

Inmortal Technique, an industry commentator and trader, recently suggested that Bitcoin's dominance in the market overcame the downward trend, while alt-coin dominance in the market remained trapped under key resistance, indicating that BTC currently has an advantage.

In a conversation with Forbes, Mati Greenspan, an analyst at eToro, also said that the “altcoin season” was over. This means that Bitcoin may soon see an influx of pressure from investors wishing to liquidate their positions in the Altcoins.

Jeff Dorman, Arca Investment Director, reiterated this:

If you look back at the beginning of April, when BTC grew by 25% in a day, all other digital assets grew. But since that day, the BTC has remained in a good position, while all other assets gradually begin to decline due to the rotation of the “Altcoins” in the BTC.

And what do you think about this?