In a significant step towards integrating blockchain into the traditional financial system, Japan’s largest banks have received approval to conduct proof-of-concept (PoC) trials for a yen-denominated stablecoin. This ambitious project, which will see Japan banks launch stablecoin, expects practical use by March 2026, according to a Nikkei report earlier this month. The initiative marks a crucial advance in the large-scale adoption of stable digital currencies in the world’s third-largest economy.

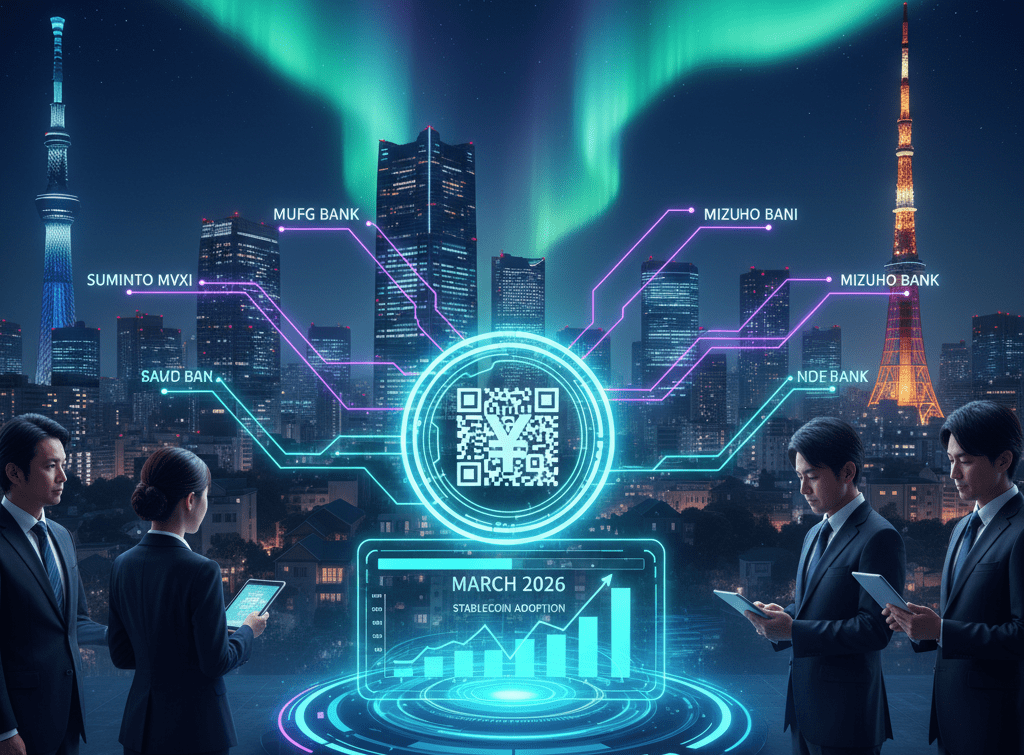

Japan’s Financial Services Agency (FSA) has authorized the stablecoin pilot, involving three banking giants: MUFG Bank, Sumitomo Mitsui Banking Corp., and Mizuho Bank. The primary objective of these PoC trials is to verify whether “regulatory and practical compliance” can be carried out “legally and appropriately” when multiple banks jointly issue a stablecoin. Initially, the focus will be on issuing a yen-pegged stablecoin. However, the banks also plan a dollar-pegged stablecoin at an unspecified future time. For this project, the banks will use the technical infrastructure of Progmat, a Tokyo-based fintech company.

According to Nikkei Asia, the banks intend their stablecoin to be in practical use by March 2026, following the finalization of the PoC trials. The stablecoin is expected to be used for both intercompany and intracompany payments, and by their corporate clients. This news comes as smaller firms have already rolled out yen stablecoins. JPYC, a Tokyo startup, announced a fully convertible yen stablecoin backed by domestic bank deposits and Japanese government bonds (JGBs).

Will this pilot drive widespread stablecoin adoption in Japan?

Despite these advances, Rajiv Sawhney, a Tokyo-based portfolio manager at Wave Digital Assets International, anticipates limited adoption initially. Sawhney points to the popularity of the QR-based payment network PayPay in Japan, which is already widely adopted by merchants. He explains that, unlike the US, Japan is already a very “cashless” country. Therefore, widespread adoption will take more time.

While USD-pepegged stablecoins still control 99% of the market, many of Japan’s Asian rivals are making fast progress when it comes to shoring up their stablecoin infrastructure. XSGD, a Singapore-dollar-based token with full Monetary Authority of Singapore oversight, was listed on Coinbase in late September. South Korea’s first fully regulated won-backed stablecoin, KRW1, launched in September in a partnership between Woori Bank and digital asset custodian BDACS. Hence, although Japan banks launch stablecoin, the regional landscape shows a race for innovation. China, however, has taken a different direction, recently clamping down on private sector efforts to launch stablecoins.