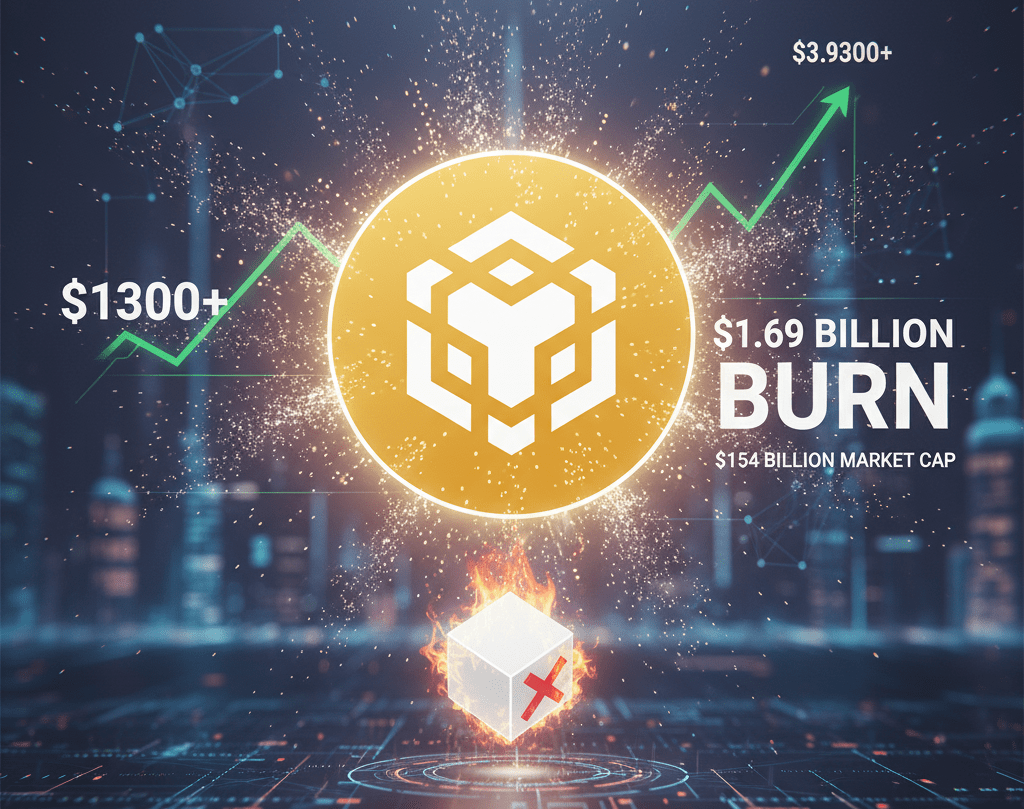

The price of BNB saw a notable rally of over 3% during the October 2025 session. This upward momentum occurred immediately after a massive scheduled asset destruction was executed. The impact of BNB token burn, valued at $1.69 billion, was confirmed in the project’s official “Report 33”. The move reshuffled the cryptocurrency rankings.

The hard data from the event is significant. The recent quarterly burn, corresponding to report 33, removed exactly 1,441,000 BNB tokens from circulation. This figure represents a market value of $1.208 billion at the time of the operation. Following this removal, the total circulating supply was reduced to 137,738,000 tokens. The market reaction was immediate. BNB’s market capitalization exceeded $154 billion. This boost allowed the coin’s price to break the $1,300 barrier, marking a milestone for investors.

This event is not isolated. It underscores the strict deflationary tokenomics Binance has applied to BNB since 2017. The goal is to reduce the total supply through automatic quarterly burns. With this latest operation, more than 54 million BNB have been removed from circulation in total. Some market analysts estimate that the cumulative value of all historical burns amounts to about $51 billion. A “token burn” is a technical mechanism that permanently removes coins from the supply. By reducing the available supply, economic theory suggests that the asset’s price may receive support if demand remains steady or increases.

Can BNB Chain adoption overshadow XRP’s regulatory troubles?

BNB’s rise in the rankings is not only due to the burn. The BNB Chain network is experiencing a significant increase in its traffic. DeFi protocols and the rise of memecoins are generating a higher volume of daily transactions. In parallel, institutional adoption is advancing. Companies and governments are testing the BNB blockchain for real-world use cases. This growth in network demand contrasts sharply with XRP’s situation. The asset managed by Ripple continues to drag regulatory problems in key jurisdictions. This legal uncertainty has limited its price jumps. The combination of factors made it easier for BNB to momentarily overtake XRP as the third-largest cryptocurrency by capitalization.

The current dynamic presents a complex picture. A lower supply combined with growing demand reinforces BNB’s scarcity narrative, attracting new liquidity. However, this same scarcity increases volatility risks. With fewer coins available, any large inflow or outflow of capital can move the price much more forcefully. This affects both traders and liquidity providers (market makers). The relative position against XRP reflects the changing market dynamics. Investors are now closely watching how the supply will evolve after future burns and how regulators will react to the growing institutional adoption of the network.